ASIFMA Tech & Ops Conference 2022

ASIFMA Tech & Ops Conference 2022

Wednesday to Thursday, 5-6 October

Hybrid | Singapore

Objective

Our flagship annual event in Asia for technology and operations is “designed by the industry for the industry” where the industry experts from sell-side, buy-side, policy makers and regulators, law firms and consultants come together to meet and discuss important issues impacting this area. The conference identifies key tech & ops related shared challenges that the industry is facing and brings market participants together to help solve these.

Review details from our 2021 event here.

Language:

English

Program Format:

Day 1 is to be held at the Fairmont Hotel, Singapore with virtual access and Day 2 will be held virtually. This two-day conference will be conducted in English and will feature keynote speeches, presentations, and panel discussions.

For more details about the event or if you would like to join the speaking faculty contact William Sargent (wsargent@asifma.org)

For sponsorship, contact Joy Balboa, Manager – Marketing and Business Development (jbalboa@asifma.org).

Platinum Sponsor

Gold Sponsors

Research Partner

At ASIFMA, we are committed to ensuring diversity and inclusion in our workplace and this policy is applied in all areas of our business including speaker roles at our events and conferences. We wish to work with members and partners who share this same commitment and are willing to support this policy.

Download the final agenda

| DAY 1 | TECHNOLOGY AND INNOVATION IN CAPITAL MARKETS (Hybrid | Fairmont Singapore) |

| 08:30-08:55 | Registration – Stamford Foyer, Level 2 |

| 09:00 – 09:05 | Opening Remarks Laurence Van der Loo, Executive Director – Tech & Ops, ASIFMA |

| 09:05 – 09:10 | Welcome Remarks Alice Law, CEO, ASIFMA |

| 09:10-10:00 | Morning Panel 1: Digitalisation and Innovation in Capital Markets – a State of Play What are the megatrends and new technology developments in capital markets? How to deliver change while supporting stability? How are firms managing tech resilience? How to ensure integration of innovative solutions in the existing capital markets ecosystem? Panelists: Laurence Thiery, Head of Financial Services, Asia, Amazon Web Services Puay Hwa Ling, MD, Head of Investment & Trading Technology, DBS Jennifer Peve, Managing Director, Head of Strategy and Business Development, DTCC Sharon Toh, Head of ASEAN Region, SWIFT Moderator: Zennon Kapron, Founder and Director, KapronAsia |

| 10:00-10:45 | Morning Panel 2: Public Cloud Adoption in Capital Markets – Opportunities and Roadblocks Benefits and opportunities for cloud adoption in capital markets, what are the use cases? What are the current regulatory approaches in the region and globally? How do firms move from legacy systems to cloud and what are the practical operational challenges? How to drive interoperability and data portability in a cloud environment? Panelists: Peter Shen, Head of Innovation and Market Data, Eastspring Investments Stuart Houston, Director, APAC Financial Services, Google Cloud Kevin O’Leary, Managing Director & APAC Regional CISO, JP Morgan Anthony Hodge, Head, Cloud Governance and Product Owner, Standard Chartered Bank Moderator: Rhys McWhirter, Partner, Head of Technology, Asia, Eversheds Sutherland |

| 10:45-11:15 | Refreshment Break |

| 11:15-12:00 | Morning Panel 3: Leveraging the Power of Data to Drive Digitalisation in Capital Markets What is the role of data in digitalising capital markets? How to transform into a data-driven organisation and how to incubate a data driven culture? What are the implications of open banking and data sharing (including for data privacy and security) and how to address these? What is the importance of data for regulatory reporting, innovation, AI adoption, regtech adoption? Can we move to a regional/global standard? Panelists: Guy Sheppard, General Manager for Financial Services, Aboitiz Data Innovation Duncan Cooper, Head of Omni Digital Services, BNY Mellon Moderator: Alice Law, CEO, ASIFMA |

| 12:00-12:45 | Morning Panel 4: Digital Assets: The Regulatory Environment Overview of the emerging regulatory approaches How to ensure a globally consistent regulatory framework? How do you balance innovation, customer protection and financial stability? Panelists: Lena Ng, Partner, Clifford Chance John Ho, Head of Legal, Financial Markets, Standard Chartered Bank Irfan Ahmad, APAC Product Lead, State Street Digital Moderator: Adrian Chng, Founder & CEO, Fintonia Group |

| 12:45-13:45 | Networking Lunch |

| 13:45-14:35 | Afternoon Panel 1: Digital Assets Adoption and Take-up in Capital Markets and the Intersection with TradFi What are the institutional considerations for entering crypto markets? Which services are traditional capital market participants venturing into (eg custody, brokerage, private asset digitisation, tokenised securities). Where is the demand and how are FIs responding? What are the benefits of blockchain in capital markets and of tokenising securities? How is DLT being integrated by banks and what are the impacts to the system architecture internally and externally? How are traditional financial services and established digital assets firms working together to institutionalise digital assets? What will be the trigger point for mass adoption? What will the end state be? Traditional vs crypto: market abuse risks and surveillance approaches What can the traditional market participants learn from the new players and vice versa? Panelists: Vince Turcotte, Director, Digital Assets, Asia Pacific, Eventus Rajeev Tummala, ASEAN Head of Securities Services (Interim); Director, Digital & Data, Securities Services, HSBC Singapore Sriram Chakravarthi, Head, Regulatory Affairs & Industry Engagement, Marketnode Damien Fontanille, Institutional Sales, Societe Generale FORGE Moderator: Whikie Liu, Director, Capital Markets Strategy, SWIFT |

| 14:35-15:25 | Afternoon Panel 2: Stablecoins How are stablecoins different from cryptocurrencies and CBDCs? What is the main motivation to issue stablecoins? What is their use case? Suggested governance arrangements (including blockchain governance, settlement mechanism, KYC etc) The role of stablecoins as a linkage between TradFi and DeFi How should stablecoins be regulated? Panelists: Andrew McCormack, Centre Head, Singapore, Bank for InternationalSettlements Innovation Hub (BISIH) U-Zyn Chua, Co founder & CTO, Cake DeFi Boon-Hiong Chan, Global Head Fund Services & Head APAC Securities Market & Technology Advocacy, Deutsche Bank Julian Kwan, CEO and Co-founder, InvestaX Moderator: Yixiang Zeng, Southeast Asia correspondent, Thomson Reuters |

| 15:25-15:55 | Refreshment Break |

| 15:55-16:40 | Afternoon Panel 3: DeFi Functions of DeFi infrastructure including smart contracts, decentralised applications, oracles and stablecoins What are the problems that DeFi is trying to solve? DeFi use-cases including credit/lending, decentralised exchanges, derivatives and tokenisation DeFi related risks and compensating controls, including smart-contract risk, governance risk, oracle risk, scaling risk, DEX risk and regulatory risk How should DeFi be regulated? Scalability, interoperability and adoption issues and solutions Panelists: Ben Wee, Vice President, Crypto.com Capital Danny Chong, Co-founder, Tranchess Chuan-Ji Lim, APAC Strategic Development Lab, UBS Moderator: Hock Lai Chia Co-chairman, Blockchain Association Singapore |

| 16:40-17:10 | Afternoon Panel 4: Case Studies; Tokenised Securities and Leveraging DLT in Capital Markets Presenters: Oi-Yee Choo, CEO, ADDX David Z Wang, Co-founder, Group CEO, Helicap Yongchuan Pan, Portfolio Manager, Ternary Fund Management Moderator: Emir Hrnjic, Academic Director, UCLA-NUS Executive MBA Program,Head of FinTech Training, Asian Institute of Digital Finance, NUS Business School |

| 17:10-17:15 | Closing Remarks Laurence Van der Loo, Executive Director – Tech & Ops, ASIFMA |

| 17:15-18:15 | Networking drinks |

| DAY 2 | OPERATIONAL OUTLOOK, RESILIENCE AND ESG (Virtual Event) |

| 12:35-12:40 | Opening Remarks Laurence Van der Loo, Executive Director – Tech & Ops, ASIFMA |

| 12:40-12:55 | Opening Keynote Julia Leung, Deputy Chief Executive Officer, Executive Director Intermediaries, Securities and Futures Commission (SFC), Hong Kong |

| 12:55-13:40 | Panel 1: Implementing Operational Resilience in APAC Updates on relative policy work of global standard-setting bodies How are authorities and firms implementing operational resilience policies including the BCBS principles, early lessons learned, consistency across firms/jurisdictions, measuring areas of success, and meeting supervisory expectations? Adapting to operational disruptions due to COVID-19 pandemic including remote working and geopolitical risks Challenges FIs are facing when implementing global and local frameworks in Asia jurisdictions Panelists: Brandon Lim, Head of Security Assurance (Regulated Sectors), APAC, Amazon Web Services Cliff Bullock, Regional Head of Operations, Asia Pacific, Invesco Raymond Chan, Executive Director, Banking Supervision, Hong Kong Monetary Authority Moderator: Janice Goh, Partner, Cavenagh Law LLP, Clifford Chance Asia |

| 13:40-14:25 | Panel 2: Outsourcing / Critical Third Parties How are regulators and firms addressing the risk posed by critical third parties? What are some of the emerging regulatory approaches? What is the view of the critical third parties? How are FIs navigating a fragmented regulatory landscape? Panelists: Frankie Tam, Of Counsel, Eversheds Sutherland Vincent Loy, Assistant Managing Director, Technology Group, Monetary Authority of Singapore Mark Morris, Global Head of Business Development, Managed Services, SmartStream Moderator: Laurence Van der Loo, Executive Director – Tech & Ops, ASIFMA |

| 14:25-15:10 | Panel 3: Greentech and Operationalising ESG How can tech support ESG goals? How can data support ESG initiatives? How are ESG considerations shaping the implementation, development and use of new technologies? Panelists: Tamara Singh, Citi – D10X team, Institutional Clients Group, Citi Helena Fung, Head of Sustainable Investing, Asia Pacific, FTSE Russell, an LSEG Business Benjamin Soh, Managing Director, STACS Moderator: Diana Parusheva-Lowery, Executive Director, Public Policy and Sustainable Finance, ASIFMA |

| 15:10-15:25 | Keynote address Yuan Lyu, Director of the Innovation Division, Digital Currency Institute, The People’s Bank of China |

| 15:25-16:15 | Panel 4: CBDCs: Capital Markets Considerations Impact of CBDCs on traditional capital markets participants What are the conditions needed for CBDCs to be a major benefit in wholesale markets? Considerations concerning the design, issuance and legal status of wCBDCs What is needed to enable globally interoperable CBDCs for cross-border payments in the wholesale space Use cases for wCBDCs in capital markets Overview of recent CBDC developments in the regional and globally Panelists: Benedicte Nolens, Centre Head, Hong Kong, Bank for International Settlements Innovation Hub (BISIH) Felix Yip, Global Head of Digital Assets Engineering, Goldman Sachs Tetsuya Inoue, Senior Researcher, Financial Market & Digital Business Research Department, NRI Douglas W. Arner, Kerry Holdings Professor in Law, University of Hong Kong Moderator: John Ball, Managing Director, Global FX Division, GFMA |

| 16:15-17:00 | Panel 5: The Evolving Cyber Threats and Regulatory Landscape What is the evolving threat landscape? Harmonising and facilitating regulatory compliance The role of the financial sector cybersecurity profile Thoughts on establishing an efficient firm-led penetration testing framework Incident reporting: fragmentation challenges and proposed solutions Panelists: Nan Maguire, Head of Information Security, Privacy and Resilience APAC, abrdn Natsuko Inui, Regional Director for Japan and East Asia, FS-ISAC David Leach, Managing Director, Cybersecurity and Technology Controls, JP Morgan Moderator: Julian Gordon, VP, Asia Pacific, Hyperledger Foundation, and Open SFF, Linux Foundation, APAC |

| 17:00-17:10 | Closing Keynote Eva Hüpkes, Head Regulatory and Supervisory Policies at Secretariat, Financial Stability Board |

| 17:10-17:15 | Closing Remarks Laurence Van der Loo, Executive Director – Tech & Ops, ASIFMA |

To effectively engage this esteemed audience and connect with the global and regional community, various sponsorship packages with speaking slots and marketing opportunities are available for ASIFMA members and non-members offering unparalleled branding exposure and lead generation. Financial institutions, vendors, consultants, and law firms are particularly encouraged to join as sponsors.

For more information on sponsorship and opportunities contact Joy Balboa, Manager – Marketing and Business Development (jbalboa@asifma.org).

Platinum Sponsor

Gold Sponsors

Research Partner

Media Partners

Endorsers

Supporting Organisation

Event Manager

For more details about the event or if you would like to join the speaking faculty contact Willim Sargent (wsargent@asifma.org)

Registration is now open!

Registration details

| In-person Event Access |

| Day 1 – Event Rates |

| Standard rate 1 September onwards |

| ASIFMA members / Endorser Members USD 220

Non ASIFMA Members USD 240 |

| Virtual Only Access |

| Day 1 and Day 2 Virtual access |

| Complimentary Virtual access for Day 1 & Day 2 Program |

CPT Hours

Day 1: Technology and Innovation in Capital Markets (CPT 6 Hours)

Day 2: Operational Outlook, Resilience and ESG (CPT 4 Hours)

* To qualify for the CPT hours mentioned above, participants are required to attend the entire event on each day.

* Attendance letters will be issued based on the number of hours attended per day. You will not be issued with an attendance letter if you do not attend all sessions for that specific day.

Media contact

This event is open to the press. For media inquiry, please contact Corliss Ruggles (cruggles@asifma.org)

*All registration requires final approval by ASIFMA and we reserve the right to cancel or decline any registration.

Hotel venue details

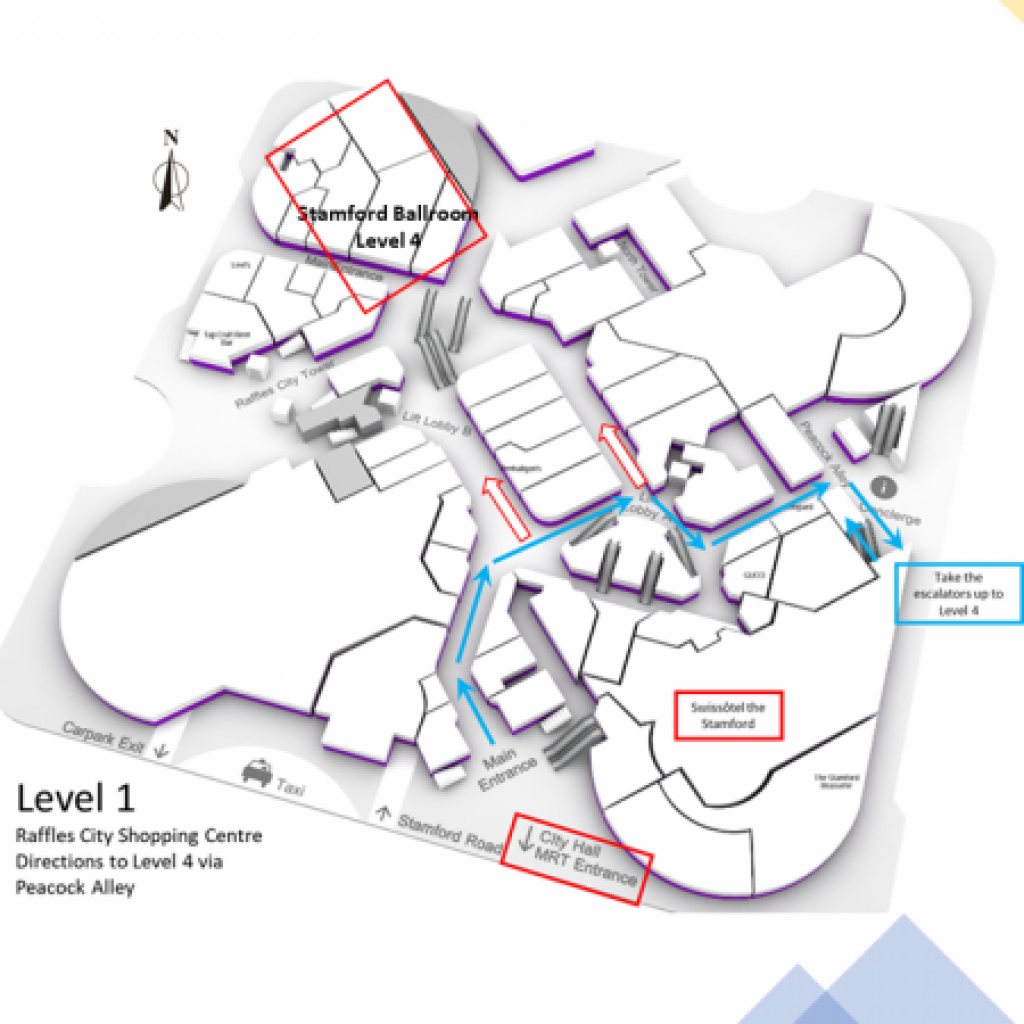

Stamford Ballroom Level 4, Fairmont Singapore

80 Bras Basah Road, 189560, Singapore

How to get to Stamford Ballroom

You may wish to use the entrance of Swissotel Lobby with the escalators leading directly up to level 4.

Guest Rooms

Delegates can enjoy a discounted rate at both The Fairmont Hotel and The Swissoltel. All hotel room reservations are dependent on availability and is on a first come first serve basis: Book your room now.

For booking inquiries and/or issues, please get in touch with:

Min Hui Seah

Assistant Conference & Event Services Manager

Fairmont Singapore & Swissôtel The Stamford

T. +(65) 6431 5513